FamilyBoost for some more than others

The FamilyBoost changes outlined by the government will disproportionately benefit the better off

The Minister of Finance, Nicola Willis, tried to give her government's beleaguered FamilyBoost programme a new coat of paint today. The Minister held a press conference and put out a press release showing that it had reformed its early childhood education (ECE) package so that “Tens of thousands of households will be better off “. Great!

Given the appalling PR and policy omnishambles that was the original FamilyBoost package, who could argue with that? In opposition, the government promised “$250 a fortnight for an average income household with children”. Then that fell to only 3,000 families getting that cash, not the average family. The Family Boost part was supposed to provide $150 a fortnight of this money. However, just 249 families received that sum in the first nine months of the scheme.

The new scheme will mean “families will get larger FamilyBoost rebates on the early childhood education fees they pay, with rebates increasing from 25 per cent to 40 per cent of weekly fees, and those with household incomes of up to $229,000 now eligible to apply”. But a quick skim of that made me go hang on - there are some choices that are being made here. Let’s have a look at what has really happened.

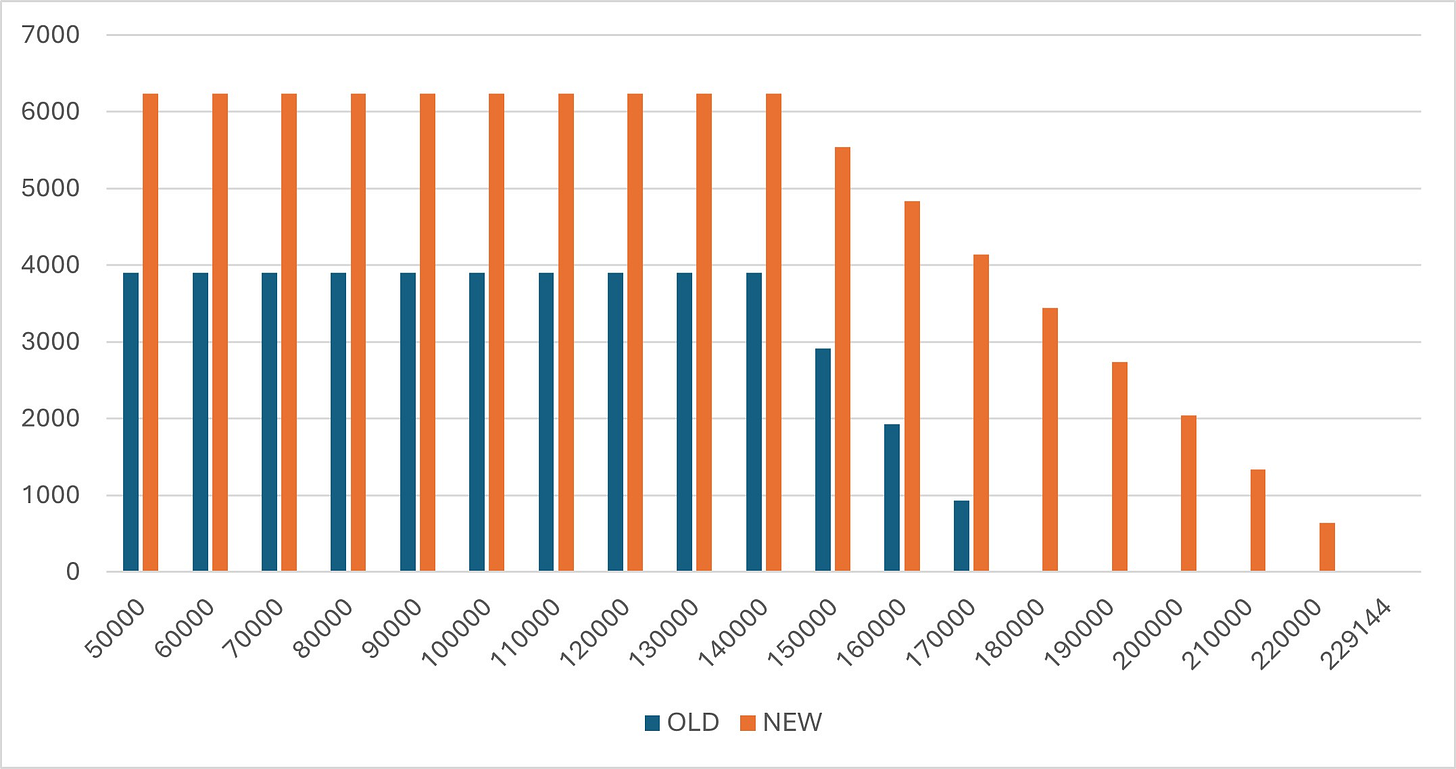

Figure 1 below shows the maximum income that families can achieve as a consequence of the old scheme and the new scheme - broken down by household income.

Figure 1: FamilyBoost Maximum Scheme Payments ($) by Household Income Level

Source: Authors Calculations based on Government PR

You can see clearly how, as claimed, the scheme is both more generous and more available to higher-income groups. But for the very discerning among you, you can also demonstrate that not all groups benefit equally. Indeed, the biggest winners from this announcement are those households on very high incomes ($180,000) – those at around the top 10% of households by income according to the 2023 Household Expenditure Survey.

Figure 2: ‘New’ FamilyBoost Income ($) by Household Income Level

Source: Authors Calculations based on Government PR

If your household earns $60,000 a year, you can get up to an extra $2,340 annually in new support. If your household earns three times that, $180,000 – you will get an extra $3,440 annually. That’s 47% more. For exactly the same thing – having children in early childhood education. Absolutely bonkers.

But wait! The HES data I pointed out above also shows how much each income decile spends on ECE. Households with incomes between $65,400 & $82,000 spend around a third of the amount per week on ECE that those households earning $182,000 and above spend. Given that this is a refund scheme, higher-earning households will tend to have higher ‘receipts’ to cash in. So they will make out twice from this revamp.

Figure 3 – Average Weekly Spending ($) by Income Decile on ECE in 2023

Source: Authors Calculations using NZ Stats Supplied Data. Very low decile income has been suppressed by Stats NZ.

So we now have scheme that:

Gives more new money to higher-income earners

Higher income earners who often access ECE more because they can afford it in the first place.

Does nothing to improve or expand ECE provision

Does nothing to make ECE more affordable for low-income groups

Does nothing to support pay equity or pay parity for ECE workers

Does nothing to make the scheme easier to use

Budgets are about choices. When you make decisions about where you put money, you show the things that you think are important. This is putting large amounts of new money in the pockets of the top 10% of income earners. Those households on $210,000 would be able to access more than $1,000 of new government support ($1,340 to be exact). This is what the government thinks is important.

This is money that could have been used instead to help those with middle and low incomes make ECE much more affordable – rather than giving it to those at the top. A higher subsidy rate for them would likely have lifted attendance at ECE for that group, and would have meant more in the pockets of those with real financial needs. It could have been used to support those with extra educational needs at a very early age – providing a pay-off for years to come. It could have been used to support the expansion of ECE centres in areas where there is high need but low provision.

What this looks like is incredibly unfocussed spending on a group that often doesn’t need financial support. But like tax cuts and landlord tax changes, this is a government committed to helping those with much already. This is money that could have done much good. It’s a shame that ‘social investment’ doesn’t apply when there is a political embarrassment to be overcome.

Do we know how much the program costs in total? Wondering how efficient this is vs just directly funding childcare.

Thanks for this analysis Craig. More children left behind. To whom that hath it shall be given. Could be their motto