Next Thursday sees the release of new GDP data for New Zealand. The last Reserve Bank Monetary Policy Statement was forecasting growth of 0.3% quarterly growth. ANZ is forecasting quarterly growth of 0.4%, as is ASB. Treasury said in its latest Fortnightly Economic Update “December quarter GDP likely increased according to indicators released so far”. Trebles all round!

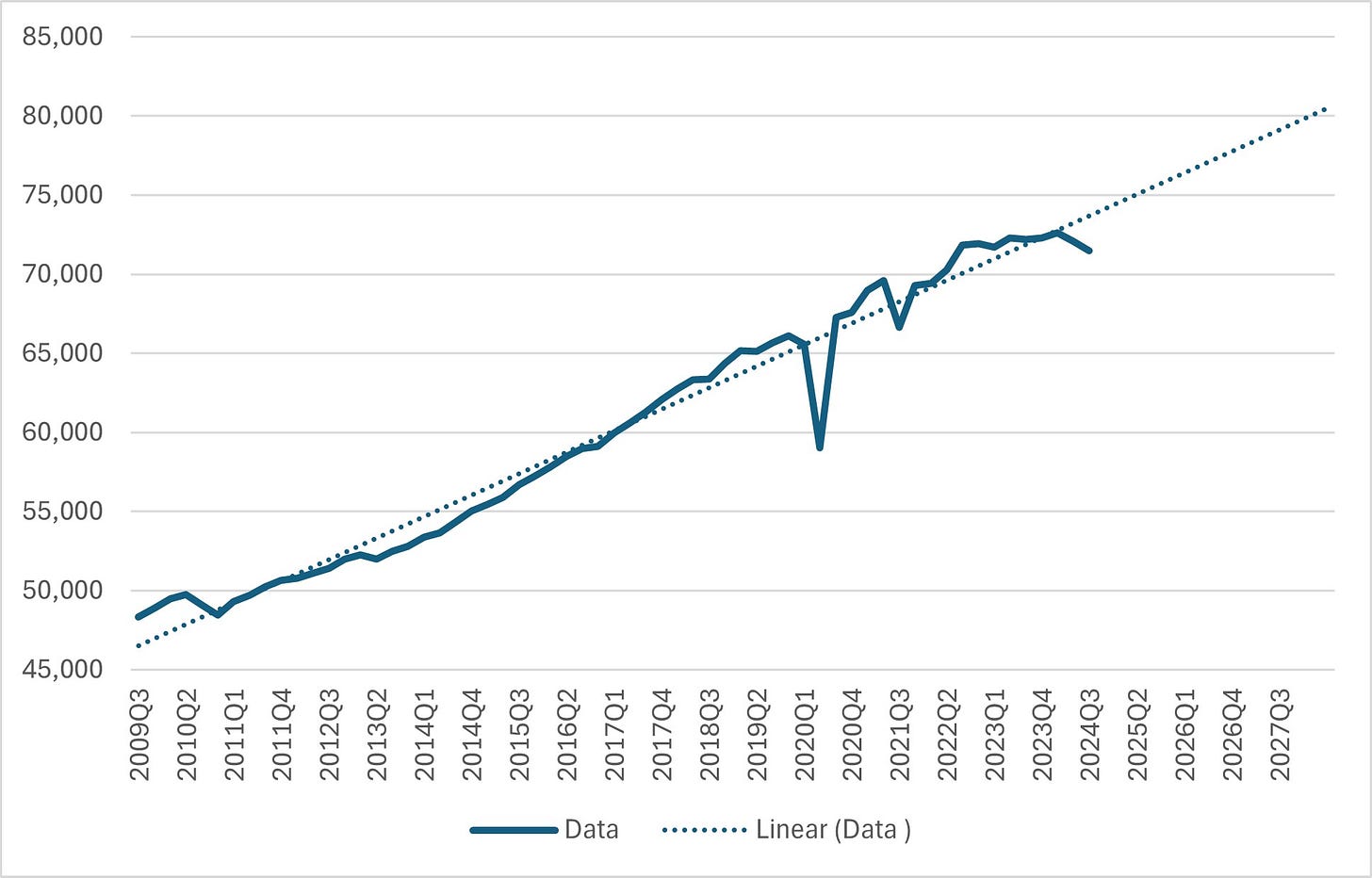

So the recession might be over. Hurray! If we are growing again that means the good times have returned…right? Well not quite. If we look at GDP growth over the long run – say since 2009 – then we can establish the trend growth rate for New Zealand. Chart 1 does this below. That works out at about 2.8% annually in real terms.

Chart 1: GDP growth since Q3 2009 and trend growth projection ($m)

Source: RBNZ Data and Author Analysis

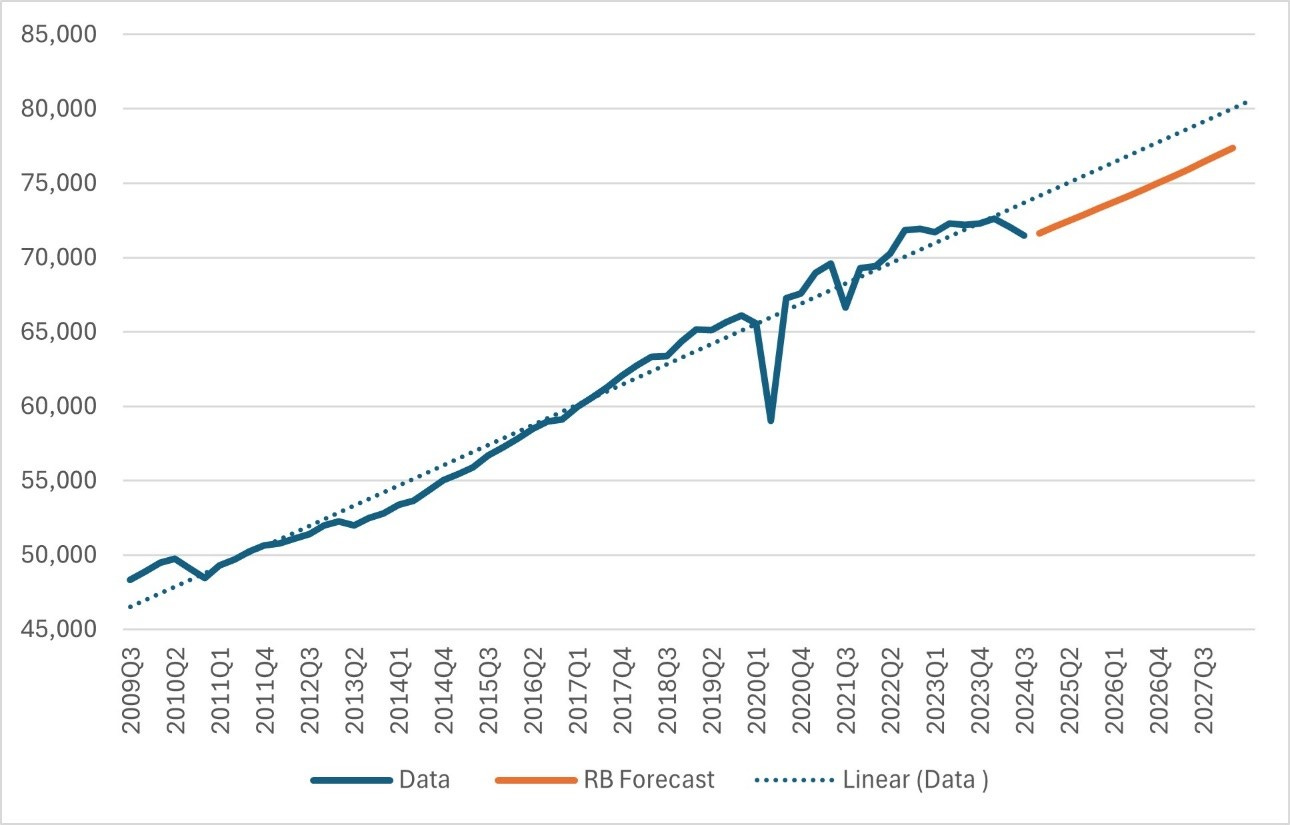

We can also use that trend rate of growth to say what would have been growth in the future if things had gone as well as in the past. That’s the dotted line in the chart. The forecast from the Reserve Bank shows what the expected forecast is now – including the forecast 0.3% GDP growth in the next quarter. That’s shown on Chart 2 GDP as the orange line.

Chart 2: GDP growth since Q3 2009, Projection, trend growth projection, and Reserve Bank projection ($m)

Source: RBNZ Data and Authors Analysis

That demonstrates the impact that the recession of 2024 has had on New Zealand. Our forecast growth never takes us back to the trend – in essence, the economy is permanently scarred. Cumulatively, across the forecast period to Q1 2028 (the end of the Reserve Bank forecast period) the economy misses out on $37.5bn of output.

The fact that we will have a tiny return to growth shouldn’t be sniffed at – it’s better than the alternative. But $37.5bn equals $18,634 dollars per household in New Zealand. Or $7,000 per person – that’s $2,333 per year in lost output. Using the core crown revenue figures for the period, that would release $10.7bn in missing taxation.

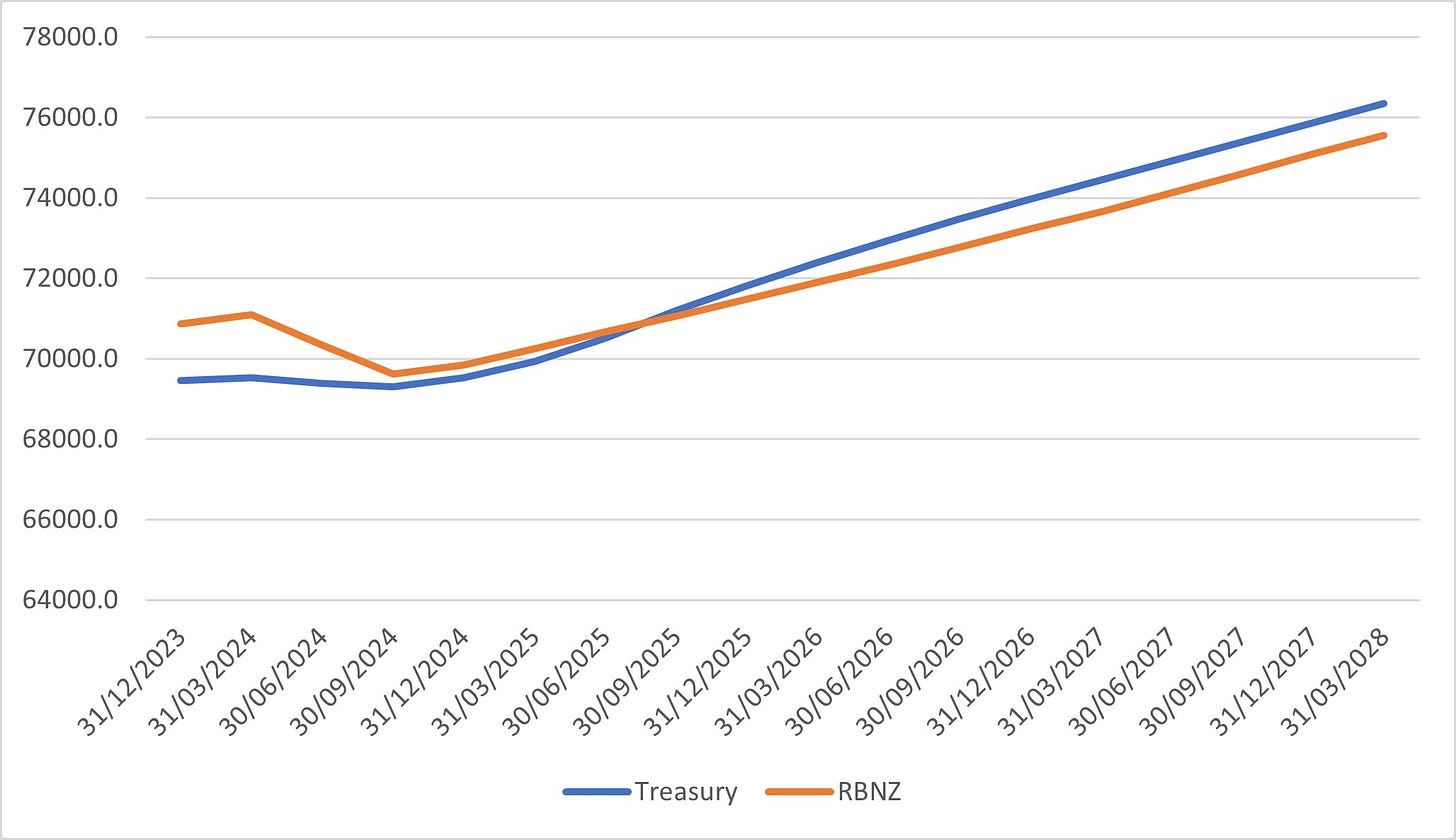

That is of course if the growth turns up – which brings us to a current set of real problems. The Reserve Bank Forecasts for GDP are similar to the Treasury HYEFU GDP forecasts. Except that after mid 2025 they are lower every period than the Treasury. The economy is 1.1% smaller by Q1 2028 than forecast by the Treasury at HYEFU.

Diagram 3 – Quarterly GDP Forecasts – RBNZ and Treasury ($m)

Source: RBNZ and Treasury Data

On this basis Budget 2025 GDP forecasts are likely to be smaller than was forecast in HYEFU in December 2024. The Minister of Finance teased us with some details this week saying “some elements will show an improvement over the previous forecasts, and some will show a decline”. The IMF forecasts that GDP will grow by 1.4% in 2025 – when forecasts from HYEFU Treasury say that growth should be 3.3%. All of these forecasts are of course much lower than the Budget 24 Forecasts, and lower than the PREFU forecasts.

Any claims to have turned the economy around since the election have to deal with the facts. On current Treasury forecasts, by June 2027 the economy will be 3.8% smaller than it was forecast at PREFU 23. The Reserve Bank and the IMF are now forecasting it to be smaller again. This isn’t rocket science. If the economy is smaller, the government either borrows more money or cut its investments. The cuts need to be even deeper to make the Government’s current fiscal strategy work.

Other factors will also make this harder. Migration keeps falling. Growing the economy at 2% is easier if there are 2% more customers each year. Net migration was 32,500 for the year to January 2025. For the same period in 2024 it was 121,800. Building work keeps falling - The value of residential building work was down 10% to $21 billion in the year ended December 2024 compared with the year ended December 2023. There were 36,500 fewer filled jobs in December 2024 than in the year previously.

Then there is the global outlook. The Trump tariff puzzle keeps finding new pieces and the international rulebook on trade has been tossed out the window. US Stock Markets such as the S&P 500 have wiped out US$4 trillion in value from their peak last month. China is struggling to reach its economic growth targets and has launched more stimulus in the hope it stokes up some domestic demand. Our exports are currently the only bright spot in the economy.

So when the numbers come in on Thursday, if they do signal the end of the recession, that’s great. Believe me, there will be celebrations – our current political challenges mean any economic victory will be grasped as if we had just won a third successive World Cup. But think of how far we have got off our long-run track – around $37.5bn off track. How far we have gotten away from the Treasury GDP forecasts at the election? How much we would all have been better off if we had stayed that course in 2023 – rather than the course plotted by this government.

Thanks Craig. This excerpt says all anyone needs to know about this government. “Our forecast growth never takes us back to the trend – in essence, the economy is permanently scarred.” Wow, what I’d say to you Christopher Luxon is: what a legacy, there is absolutely nothing, and I mean nothing, to be proud of.

Thanks Craig!

I hope Luxon put his money in the US stock market after he sold some houses...