Two interviews on Newstalk ZB this week – one from the Prime Minister and one from the Minister of Finance. Both of which tackled a subject that hasn’t been on many peoples radar – corporate tax. They both indicated that a cut to corporate taxation was on the cards as a means of encouraging investment and economic growth. The New Zealand Initiative was immediately on hand to support such a move.

36% of small and medium sized businesses had cutting corporate taxes as one of their top 5 policy requests for Budget 2024. Corporate tax (sometimes known as company tax) has been set at the same rate since 2010 when Bill English reduced it from 30% to 28%. During that time other countries around the world have reduced their rates, notably the US, which saw a fall from 35% to 21% in 2017 under President Trump.

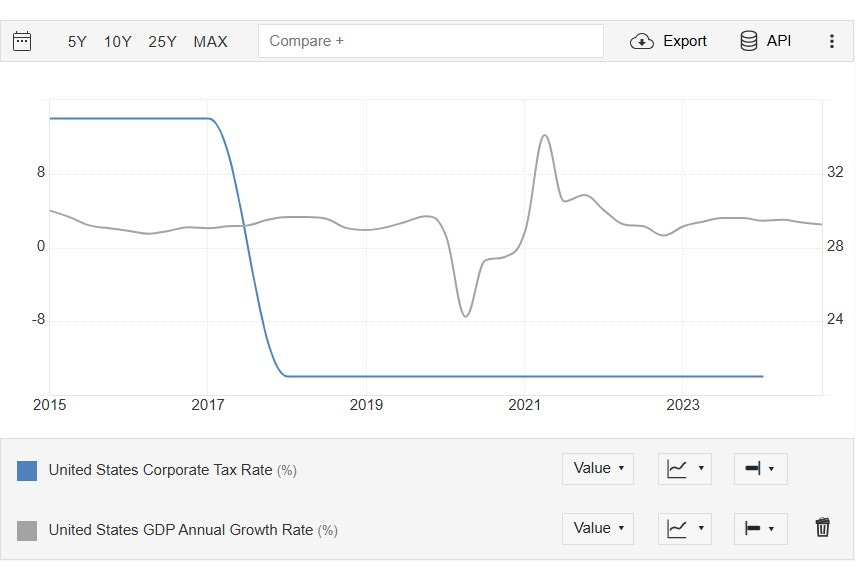

Could cutting company taxes here be the magic ingredient in helping deliver the growth that New Zealand has been missing? Like much of economics, this idea is based on theory, not practice. In theory, a lower tax rate would encourage firms to move to New Zealand. It would also encourage firms to expand given that they would have more of an incentive to grow. That in turn should lead to economic growth. Yet the real-world evidence for this doesn’t really exist. Take the US example. We can plot annual GDP growth against the change in corporate taxes

Chart 1: US Corporate Taxation vs US GDP Annual Growth.

Source: tradingeconomics.com

US Corporate taxes fell – and absolutely nothing changed in terms of growth. Australia has a higher corporate tax rate for firms with a turnover of more than A$50m (30%) than New Zealand. Yet it has a more productive economy and stronger economic growth. Greece has a lower corporate tax rate (22%) yet its economy has struggled. There is no direct and simple relationship between the two.

In Aotearoa the structure of tax is different too. Firms don’t pay capital gains taxes – which they may pay overseas. They don’t pay social security or payroll taxes, which are prevalent in many jurisdictions (think National Insurance in the UK). Corporate taxes are just one part of the over mix of taxes that firms pay – meaning that investment decisions are usually made on more sophisticated grounds than just ‘corporate tax is low’.

But back to the central question “Do corporate tax cuts boost economic growth”. When Economists have looked at this – the answer seems to ‘not really’. One of the largest studies in this area, looking at 42 reviews found that “corporate tax changes have, on average, no economically relevant or statistically significant effect on economic growth”. What they did find was that “The literature on corporate taxes and growth has been biased towards over-reporting results according to which corporate tax cuts boost growth rates. We have shown that it is about 2.7 to 3 times more likely to publish a result showing a statistically significant positive impact of corporate tax cuts on growth compared to a significant negative result”.

In New Zealand papers prepared by Inland Revenue and the Treasury for the 2018 Tax Working Group also looked at this issue. They came to the conclusion that “reductions in New Zealand’s company tax rate are unlikely to lead to large welfare gains”. The Oxford University Centre for Business Taxation came to the same conclusion about corporate tax cuts there, saying that they were “very unlikely to significantly impact long-run growth.”

What is known is that the tax cuts cost the government money, and that the winners and losers from corporate tax cuts look very different. This fiscal year corporation tax will generate around $17bn in net taxes – around 14% of all government revenue ($120bn). That’s more than twice what we spend on law and order in New Zealand ($7.5bn). Cuts to corporate taxes can only come at the cost of more cuts to public services. The same ones already being cut to pay for the tax cuts just delivered.

Cuts to corporate tax cuts also impact income inequality. Studies of corporate tax cuts have shown that they lead to increases in the share of income accruing to the top 1 % of income earners. Specifically, a 1% corporate tax cut increases the share of income to the top 1 percent of the income distribution by 1.5%. A paper examining the Trump corporate tax cuts for the US Congres showed nearly all of the benefits of the 2017 US$1.3 trillion tax cut went to high-income shareholders and executives. This means executives alone pocketed $13.2 billion annually—a pay bump of roughly $50,000 per executive—while median workers received nothing.

There is no reason to think that this would play out any differently in New Zealand. We would be cutting investment in public services, to better renumerate high-income earners. Doing this right now also make no fiscal sense. The governments books are already deeply in the red to pay for the last set of tax cuts – including $3bn for landlords. OBEGAL is in deficit for the entire forecast period, and government debt is already climbing by $57bn – or 34% - across the next five years. Is now the time for another tax giveaway?

New Zealand could be tackling the issues that will deliver long-term sustainable growth. Moving us to a fully renewable energy system. Investing in education, skills, and supporting people in work. Building the infrastructure we desperately need. Growing the new areas of the economy that will be the job generators of the future. We are cutting these areas right now, and watching the population leave. The 127,800 migrant departures in the November 2024 year are, provisionally, the highest on record for an annual period.

Corporate taxation is not the solution to better long-term growth in New Zealand. The famous “Kansas Experiment” in 2012 saw taxes eliminated on business income for the owners of almost 200,000 businesses in the state. It was an unmitigated disaster. Revenue collapsed. Spending on services had to be slashed. Rather than creating jobs, by 2018 overall growth job creation in Kansas had underperformed the national economy, neighbouring states, and growth in Kansas in previous years.

In the Wizard of Oz, Dorothy said “We’re not in Kansas anymore”. New Zealand shouldn’t follow the yellow brick road there for economic growth anytime soon.

The chief economic courtesan for the Business Roundtable/NZ Initiative suggests increasing the (regressive) goods and services tax to compensate for reducing corporate tax rates. The usual 'look after the wealthy/screw the poor' approach.

Two immediate thoughts: 1. the evidence shows it doesn’t work therefore this government will jump on it. 2. A major report last year showed that a major underpinning of inflation was the profits from large corporates.

Agree with @andrewriddell x look after the wealthy /screw the poor. And sink the middle class even further…